Why Choose Us?

0% AI Guarantee

Human-written only.

24/7 Support

Anytime, anywhere.

Plagiarism Free

100% Original.

Expert Tutors

Masters & PhDs.

100% Confidential

Your privacy matters.

On-Time Delivery

Never miss a deadline.

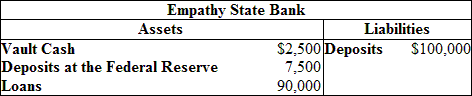

Lincoln Memorial University - ECON 211 Ch 12 Macro 1)(Table) SCENARIO: Assume that the Empathy State Bank begins with the balance sheet below and is fully loaned up

Lincoln Memorial University - ECON 211

Ch 12 Macro

1)(Table) SCENARIO: Assume that the Empathy State Bank begins with the balance sheet below and is fully loaned up. This bank's reserve ratio is:

|

|

|

|||||

|

|

|

|||||

|

|

|

|

2. |

Which list represents monetary policy actions that are consistent with one another? |

|||||

|

|

|

|||||

|

|

|

|

3. |

Monetary policy, like fiscal policy, is subject to _____ lags. |

|

|

|

|

|

4. |

If Abigail withdraws $300 cash from her checking account, her bank's assets then: |

|

|

|

|

|

5. |

When the Fed buys bonds, its demand _____ the price of bonds, _____ nominal interest rates. |

|||||

|

|

|

|||||

|

|

|

|

6. |

Sumit deposits $1,500 cash into his checking account. The reserve requirement is 25%. What is the change in his bank's required reserves? |

|

|

|

|

|

7. |

A lower reserve requirement: |

|

|

|

|

|

8. |

The main policymaking arm of the Fed is the: |

|||||

|

|

|

|||||

|

|

|

|

9. |

Open market operations involve the purchase and sale of: |

|

|

|

|

|

10. |

Sumit deposits $1,500 cash into his checking account. The reserve requirement is 25%. How much money can the banking system create? |

|||||

|

|

|

|||||

|

|

|

|

11. |

The discount rate is: |

|

|

|

|

|

12. |

If the reserve requirement is 10%, a withdrawal of $500 leads to a potential decrease in the money supply of: |

|

|

|

|

|

13. |

If banks increase excess reserves to increase their ability to absorb a higher rate of defaults: |

|||||

|

|

|

|||||

|

|

|

|

14. |

Which of these is a basic goal of the Federal Reserve System? |

|

|

|

|

|

15. |

The Fed announced in September 2013 that it would postpone winding down its monetary stimulus until the economic recovery was stronger. When the Fed does finally begin to reduce bond purchases: |

|||||

|

|

|

|||||

|

|

|

|

16. |

The main tool of monetary policy is: |

|

|

|

||

|

|

|

|

17. |

Which statement concerning the structure of the Federal Reserve System is correct? |

|

|

|

|

|

18. |

If the reserve requirement is 25% and a new deposit leads to a potential increase in the money supply of $4,000, the amount of the new deposit must equal: |

|||||

|

|

|

|||||

|

|

|

Expert Solution

PFA

Archived Solution

You have full access to this solution. To save a copy with all formatting and attachments, use the button below.

For ready-to-submit work, please order a fresh solution below.