Why Choose Us?

0% AI Guarantee

Human-written only.

24/7 Support

Anytime, anywhere.

Plagiarism Free

100% Original.

Expert Tutors

Masters & PhDs.

100% Confidential

Your privacy matters.

On-Time Delivery

Never miss a deadline.

How many shares will Green repurchase as a result of the debt issue? How many stock repurchase plan? al is the expected return on the firm's equity after the announcement ol lhe 24

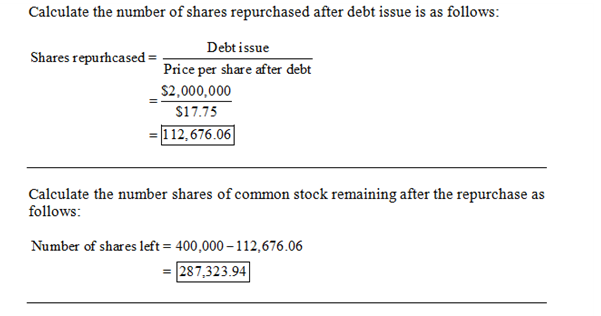

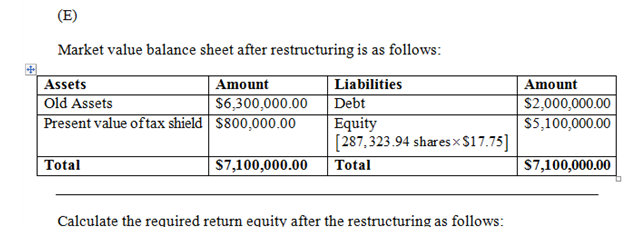

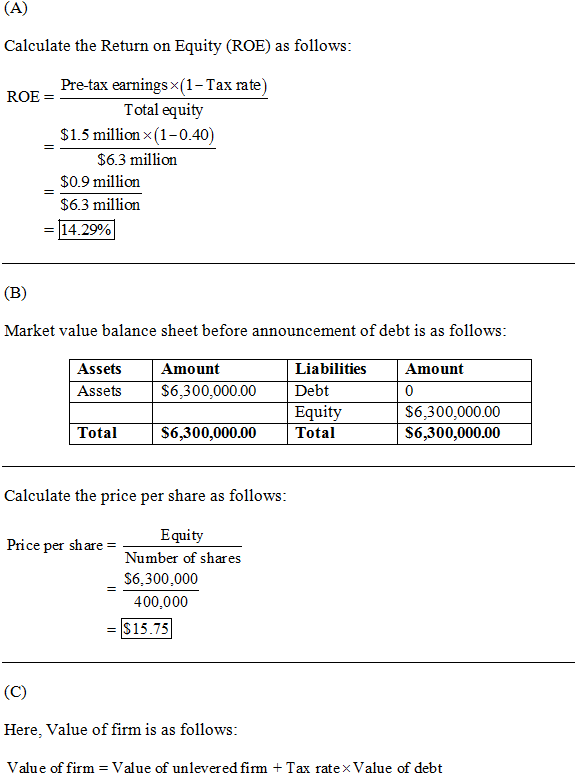

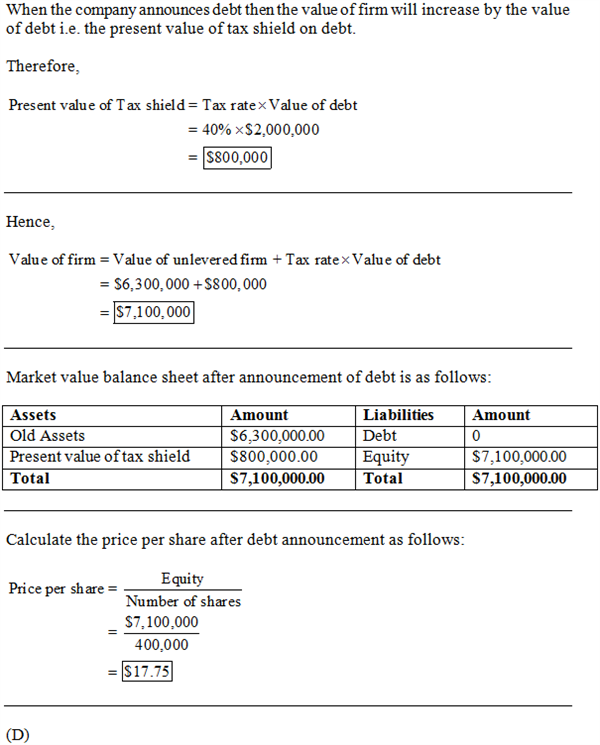

How many shares will Green repurchase as a result of the debt issue? How many stock repurchase plan? al is the expected return on the firm's equity after the announcement ol lhe 24. Stock Value and Leverage Green Manufacturing, Inc., plans to announce that it will issue $2 million of perpetual debt and use the proceeds to repurchase common stock. The bonds will sell at par with a coupon rate of 6 percent. Green is currently an all-equity firm worth $6.3 million with 400,000 shares of common stock outstanding. After the sale of the bonds, Green will maintain the new capital structure indefinitely. Green currently generates annual pretax earnings of $1.5 million. This level of earnings is expected to remain constant in perpetuity. Green is subject to a corporate tax rate of 40 percent. a. What is the expected return on Green's equity before the announcement of the debt issue? b. Construct Green's market value balance sheet before the announcement of the debt issue. What is the price per share of the firm's equity? c. Construct Green's market value balance sheet immediately after the announce- d. What is Green's stock price per share immediately after the repurchase shares of common stock will remain after the repurchase? f. Construct the market value balance sheet after the restructuring. 2. What is the required return on Green's equity after the restructuring? Taxes Williamson, Inc., has a debt-equity ratio of 2.5. The firm's ment of the debt issue. announcement?

Expert Solution

olution

debt-equity should be 2,000,000/5,100,000.

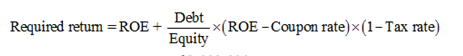

And the correct ROE=14.29%+(2,000,000/5,100,000)x(14.29%-6%)x(1-40%)=16.24% approx.

Archived Solution

You have full access to this solution. To save a copy with all formatting and attachments, use the button below.

For ready-to-submit work, please order a fresh solution below.