Why Choose Us?

0% AI Guarantee

Human-written only.

24/7 Support

Anytime, anywhere.

Plagiarism Free

100% Original.

Expert Tutors

Masters & PhDs.

100% Confidential

Your privacy matters.

On-Time Delivery

Never miss a deadline.

Socks Ltd manufactures socks and legwarmers and wants to expand its product line

Socks Ltd manufactures socks and legwarmers and wants to expand its product line. The management of the company has indicated that a new machine is required to manufacture a new line of brightly coloured socks. To purchase the machine, it has negotiated financing with a favourable before tax cost of 3% interest per annum with equal annual instalments. Alternatively, the company can enter into a direct financial lease with the manufacturer of the machine, which means that the manufacturer will offer the machine and maintenance on it for the useful life of the machine at a cost of R 300 000 per year, paid at the start of each year for three years. The machine costs R 600 000 and it is expected that it will require maintenance of R 80 000 per year, if bought. It is also expected that the machine can be sold for R 100 000 at the end of its useful life of three years. The machine can be depreciated by way of the straight-line method over a period of three years. A tax rate of 28% is applicable. The company has a before tax cost of debt of 11%. Required: Determine the net advantage of leasing and advise the company on the option they should take based on your finding

Expert Solution

Questions ask you to evaluate the Two options whether purchase of machine is better or to take it on lease is better purely in terms of financials.

You need to calculate the Costs associated with both options and analyse which is less costly.

Given rate 11% is before tax. We need after tax rate as the cash flows we use also after tax. So 11(1- tax)

=11( 1- 0.28) = 7.92%

Step 1: Evalute Lease option:

300000 per year lease payments for 3 years starting at the beginning of year. Present value of Net Cost in this option is:

| Year end | Cash outflow before tax | Tax saving on Lease payments | Net Cash outflows | PV factor @ 7.92% | Present Value |

| 0 | 300000 | 84000 | 216000 | 1 | 216000.00 |

| 1 | 300000 | 84000 | 216000 | 0.9266 | 200148.26 |

| 2 | 300000 | 84000 | 216000 | 0.8584 | 185408.30 |

| Total | 601556.56 |

Total Costing in Lease is 601556.56

Step-2 Evaluation Buying Options;

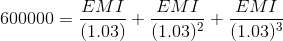

1st you need to calculate the Anunual payments and interest part.

EMI = 212118 Approx

Now draw amortization table to calculate the Interest portion a separetely:

| Beginning Balance | Interest @ 3% | EMI | Principal Portion ( EMI - Interest) |

Ending Balance ( Beginning value - Principal) |

| 600000.00 | 18000.00 | 212118.00 | 194118.00 | 405882.00 |

| 405882.00 | 12176.46 | 212118.00 | 199941.54 | 205940.46 |

| 205940.46 | 6177.54 | 212118.00 | 205940.46 | 0.00 |

Present value of all costing is as:

| Year end | EMI/Annual Payments | Tax saving on interest payments | Tax saving on Depreciation of 200000 | After tax Maintenance cost= 80000x0.72 | Salvage value Less tax on captal gain. 100000-(100000*0.28) |

Net Cash outflows Annual payment + Maintenance cost - Savings |

PV factor @ 7.92% | Present Value |

| 1 | 212118 | 5040.00 | 56000 | 57600 | 0 | 208678.00 | 0.9266 | 193363.60 |

| 2 | 212118 | 3409.41 | 56000 | 57600 | 0 | 210308.59 | 0.8584 | 180522.95 |

| 3 | 212118 | 1729.71 | 56000 | 57600 | 0 | 211988.29 | 0.7952 | 168563.93 |

| 3 | 0 | 0 | 0 | 0 | 72000 | -72000 | 0.7952 | -57254.40 |

| Total | 485196.08 |

= 485196.08

Net advantage on lease = 485196.08-601556.56 = -116360.48

So it is clear from th above working that took loan and purchase machnery is better option than lease.

Archived Solution

You have full access to this solution. To save a copy with all formatting and attachments, use the button below.

For ready-to-submit work, please order a fresh solution below.